Reliance in its golden decade will set even more ambitious growth goal

By Team Startupcity | Friday, 19 June 2020, 19:21 IST

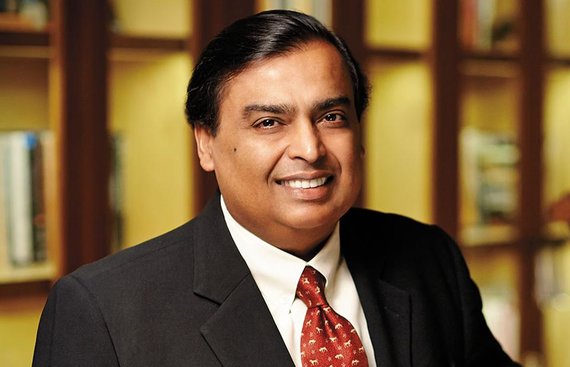

Reliance Industries Limited (RIL) is heading towards a bright future. With its endeavours to set even more ambitious growth goals, Mukesh Ambani, Chairman and Managing Director announced that the company has become net debt-free after having raised Rs1.75 trillion while its debt stood at Rs1.61 trillion. "On the proud occasion of becoming a net debt-free company, I wish to assure them that Reliance in its Golden Decade will set even more ambitious growth goals, and achieve them, in fulfilment of the vision of our Founder, Dhirubhai Ambani, to consistently increase our contribution to India’s prosperity and inclusive development," he says.

Ambani has affected a massive pivoting of India's largest private sector company from being a petchem and fuel refining entity to getting into retail and then entering telecom to become India's largest mobile services company with 388 million users in less than five years of launch. In the last two months, it raised Rs1.15 trillion by selling 24.71 per cent equity of its subsidiary Jio Platforms. It also raised Rs 153,124.20 crore through a rights issue of its own shares. Prior to that, RIL had raised around Rs7,800 crore by selling 49 per cent stake in its fuel retailing business to BP.

"Along with the stake sale to BP in the petro-retail JV, the total fund raise is in excess of Rs1.75 lakh crore. Our net-debt was Rs161,035 crore, as on 31st March 2020. With these investments, RIL has become net debt-free," RIL said in a release.

The RIL rights issue, which was subscribed 1.59 times, was not only the largest ever in India, but also the largest in the world by a non-financial entity in the last ten years.

In all likelihood, Jio Platforms has now concluded its fund-raising exercise that in 58 days saw 10 investors commit to investing Rs1.15 trillion in the RIL subsidiary for a combined 24.71 per cent stake.

The list of Jio investors includes Facebook, six private equity companies namely General Atlantic, TPG, KKR, Silver Lake, L Catterton, Vista Equity Partners, two sovereign funds of Abu Dhabi namely Abu Dhabi Investment Authority and Mubadala Investment Company and Saudi Arabia's sovereign wealth fund Public Investment Fund (PIF).

The breathtaking fund raising by Jio and the rights issue have come at a time when the world is in the grip of the covid19 pandemic and a recession. Ambani had set 31 March, 2021 as the deadline for his conglomerate to be net debt-free but has achieved the status well ahead of that.

Read More News :

.jpg)

.jpg)