Bank of India shares tumble by 12 percent

By

siliconindia | Thursday, October 29, 2009

Bangalore: The Bank of India (BOI) stock went down by over 12 percent on a day when Sensex ended in the red as selling continued market. After opening at  408.10, the stock touched a low of

408.10, the stock touched a low of  355 before ending the day slightly higher at

355 before ending the day slightly higher at  357.80 down 12.33 percent or

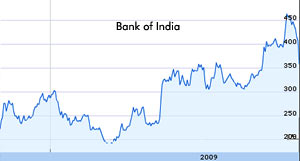

357.80 down 12.33 percent or  50.30. Through the day, 902,945 BOI shares were traded in the market, with the current P/E ratio of the stock at 6.20. The 52 week stock price chart is on the left.

Bank of India operates in three business segments - treasury operations, wholesale banking and retail banking and the bank has six credit card products. As of March 31, 2009, BOI's customer deposits stood at

50.30. Through the day, 902,945 BOI shares were traded in the market, with the current P/E ratio of the stock at 6.20. The 52 week stock price chart is on the left.

Bank of India operates in three business segments - treasury operations, wholesale banking and retail banking and the bank has six credit card products. As of March 31, 2009, BOI's customer deposits stood at  30,221 crore and its gross investment were at

30,221 crore and its gross investment were at  53,317.00 crore. As of March 31, 2009, the bank had 3021 branches in India and it had presence in four continents and 15 countries. On Thursday, the bank asked for

53,317.00 crore. As of March 31, 2009, the bank had 3021 branches in India and it had presence in four continents and 15 countries. On Thursday, the bank asked for  20 billion of capital infusion from the central government. The bank will also provide

20 billion of capital infusion from the central government. The bank will also provide  4 billion of additional provision in the next four quarters to reach a provision coverage target of 70 percent from 59 percent at present.

Currently, out of the 28 analysts following the stock, the consensus recommendation is to hold the stock, with nine analysts suggesting to hold BOI. UTI Infrastructure Advantage Fund - Series I holds the highest number of BOI shares, with 1,000,000 shares in its portfolio.

4 billion of additional provision in the next four quarters to reach a provision coverage target of 70 percent from 59 percent at present.

Currently, out of the 28 analysts following the stock, the consensus recommendation is to hold the stock, with nine analysts suggesting to hold BOI. UTI Infrastructure Advantage Fund - Series I holds the highest number of BOI shares, with 1,000,000 shares in its portfolio.

408.10, the stock touched a low of

408.10, the stock touched a low of  355 before ending the day slightly higher at

355 before ending the day slightly higher at  357.80 down 12.33 percent or

357.80 down 12.33 percent or  50.30. Through the day, 902,945 BOI shares were traded in the market, with the current P/E ratio of the stock at 6.20. The 52 week stock price chart is on the left.

Bank of India operates in three business segments - treasury operations, wholesale banking and retail banking and the bank has six credit card products. As of March 31, 2009, BOI's customer deposits stood at

50.30. Through the day, 902,945 BOI shares were traded in the market, with the current P/E ratio of the stock at 6.20. The 52 week stock price chart is on the left.

Bank of India operates in three business segments - treasury operations, wholesale banking and retail banking and the bank has six credit card products. As of March 31, 2009, BOI's customer deposits stood at  30,221 crore and its gross investment were at

30,221 crore and its gross investment were at  53,317.00 crore. As of March 31, 2009, the bank had 3021 branches in India and it had presence in four continents and 15 countries. On Thursday, the bank asked for

53,317.00 crore. As of March 31, 2009, the bank had 3021 branches in India and it had presence in four continents and 15 countries. On Thursday, the bank asked for  20 billion of capital infusion from the central government. The bank will also provide

20 billion of capital infusion from the central government. The bank will also provide  4 billion of additional provision in the next four quarters to reach a provision coverage target of 70 percent from 59 percent at present.

Currently, out of the 28 analysts following the stock, the consensus recommendation is to hold the stock, with nine analysts suggesting to hold BOI. UTI Infrastructure Advantage Fund - Series I holds the highest number of BOI shares, with 1,000,000 shares in its portfolio.

4 billion of additional provision in the next four quarters to reach a provision coverage target of 70 percent from 59 percent at present.

Currently, out of the 28 analysts following the stock, the consensus recommendation is to hold the stock, with nine analysts suggesting to hold BOI. UTI Infrastructure Advantage Fund - Series I holds the highest number of BOI shares, with 1,000,000 shares in its portfolio.