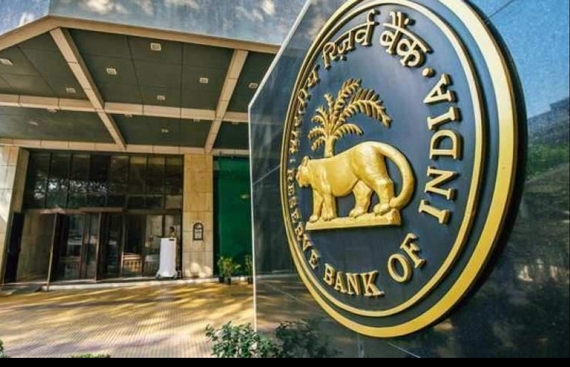

RBI Permits Piramal Group to Take Charge of DHFL

The

The development comes post a month after the Committee of Creditors (CoC) of DHFL voted in favour of Piramal's bid with 94 percent votes and approved its resolution plan.

In a statement released by Piramal Group, "We understand that the RBI has approved the DHFL resolution plan from Piramal Capital and Housing Finance, submitted by the CoC."

Currently, the proposed takeover requires the approval of the National Company Law Tribunal.

The other major contender for the debt-ridden NBFC was US-based

The total offer of Piramal was  37,250 crore, compared to

37,250 crore, compared to  38,400 crore offered by Oaktree. However, Piramal had provided higher upfront cash payment. The total dues of DHFL stand at around

38,400 crore offered by Oaktree. However, Piramal had provided higher upfront cash payment. The total dues of DHFL stand at around  90,000 crore.

90,000 crore.

Piramal, in its proposal, has offered an additional amount in the resolution process to fixed deposit holders, over and above what the CoC offers them through the IBC resolution.

Read More News :

L&T Construction Grabs the Deal to Construct 2 units of Kudankulam Nuclear Power Project

.jpg)