Adani, Reliance Quietly Tap Chinese Tech Amid Tariff Turmoil

By

siliconindia | Tuesday, 19 August 2025, 08:49 Hrs

- Adani, Reliance and JSW are quietly exploring Chinese tech in EVs, batteries and renewables despite political tensions.

- Indian firms are routing deals through third countries like Singapore and Vietnam to bypass restrictions on Chinese investment.

- Trump’s tariff war is reshaping supply chains, nudging India and China closer even as risks of dependence remain high.

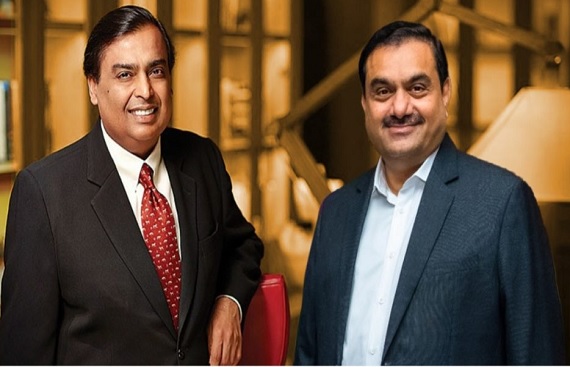

India’s biggest business groups, including those led by Gautam Adani, Mukesh Ambani, and Sajjan Jindal, are quietly exploring partnerships with Chinese firms even as political mistrust between New Delhi and Beijing lingers. According to a Bloomberg report, this comes at a time when US President Donald Trump’s tariff war is reshaping global supply chains, pushing Indian companies to look for Chinese technology in areas such as electric vehicles, batteries, and renewable energy.

Despite India’s restrictions on Chinese investment since the 2020 Galwan Valley clash, companies are finding new ways to work around the rules. Executives are discreetly seeking technology transfers through overseas subsidiaries of Chinese firms in places like Singapore, Vietnam, and Hong Kong. These deals often include technology-sharing agreements while avoiding direct political scrutiny.

Bloomberg reported that Gautam Adani recently met with major Chinese players such as CATL, the world’s largest battery maker, and EV giant BYD. While the Adani Group has denied talks, JSW Group has already partnered with Chery Automobile to source EV technology. Reliance Industries is also said to be considering investments in Chinese-origin battery firms as it expands into fuel cells and battery manufacturing, though the company has not commented publicly.

Experts say Indian conglomerates are turning to China because they lack advanced technology in clean energy and batteries. As India accelerates its plans for EVs and renewable energy, dependence on Chinese know-how could become unavoidable. Analysts note that while India is being courted by the West as a counterbalance to China, Trump’s tariffs have paradoxically brought the two Asian rivals closer in supply chain cooperation.

Also Read: Adani and MetTube Join Forces to Boost India's Copper Tube Manufacturing and Self-Reliance

Political signals are also improving. India has reinstated visas for Chinese tourists, Beijing has eased restrictions on urea exports, and direct flights may resume soon. Chinese Foreign Minister Wang Yi’s visit to New Delhi comes ahead of a possible meeting between Prime Minister Narendra Modi and President Xi Jinping at the SCO Summit, raising hopes of a thaw in ties.

However, risks remain. India has previously blocked large investments from Chinese automakers, and experts warn that technology transfers may come with demands for greater access to India’s consumer market. Still, industry analysts believe Indian firms have little choice but to secure Chinese components if they want to compete in the global EV and renewable energy race.