Will Stronger Trade Tides with The EU Benefit Indian SME'S

Aretha Capital Partners Ltd. is a London-based, partner-owned and operated, advisory firm with a founding team has a combined experience of over a hundred years in financial services, investments, immigration, media and real estate. The firm is headed by Ashish S, an experienced investment manager with a demonstrated history of working in the investment management industry.

How is Mapping China's consumption of EU's Golden Visa Programs and their SME Trade with Europe

India and China have been pitted against each other owing to their cohesive role in shifting the global power balance to the east. With a significant number of resources and human resources at their disposal, India and China have aided in altering world dynamics socially, economically, and politically. Despite both the nations embarking on different paths towards development, many draw similarities in their affinity towards immigration, wealthy population, and business acumen.

A Deeper Look Into The India Vs China Debate

Indians and Chinese both constitute a significant chunk of the world's immigrant population. Despite this tendency to move abroad, the routes taken by the people from the two countries are poles apart. India has traditionally been a provider of soft services and skilled labour to countries around the world. When we look at this trajectory empirically, we can see that a large number of the Indian diaspora avails a more significant chunk of skilled work visa programs and permits than the Chinese. The manifestation of this trend can be seen in the significantly high work population of Indian origin in countries like Canada, the UK, the US & Australia. The skill-driven migration of talent can be seen in the eventual commercial success of Indians on the global stage, where many lead renowned corporations as their CEOs, CXO's, etc. However, when we look at the investment route, the numbers are severely contrasting. Over the last decade, Indians have contributed less than 10% to the investor visa categories combined.

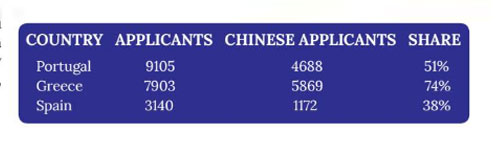

In contrast, Chinese SMEs have taken up over 50% of the available investment visas in various countries, including Europe. Let’s look at some numbers.

The large-scale foreign investment by the Chinese invariably results in a significant amount of trade between China and the rest of the world. The rise of China as an industrial superpower has revamped global politics. From being the world's factory to the hub of the most advanced technological advancements, it has become the one nation that the world is dependent on for almost everything manufacturing, and tech. China represents approximately 14% of the EU's external trade, nearly seven times India's share. These numbers highlight India's untapped potential.

What Will Happen When India Decides To Take The Investment Route?

A review of the Indian export & import data showcases that 60 percent of trade is conducted by companies valued at under 100 crores, and large conglomerates undertake only 40 percent. Therefore, small & medium enterprises are at the heart of India's economic growth. With the European market being one of the world's largest consumers of tech-based solutions and tech-backed Indian SMEs focused on offering solution-driven products and services - stronger ties with the EU could be a game-changer for both nations.

When Indian SMEs jump on a similar investment visa bandwagon with Europe. In that case, they could fill the existing need gap between the challenge (posed by India’s trade deficits with many countries) and the opportunity (existence of many complimenting products) that stands before them.

India's focus on building an Atmanirbhar Bharat (self-reliant) has given birth to a slew of small and medium enterprises under the 100-crore mark that can trade with Europe by either exporting or importing products/services. Deeper trade ties with the European Union acquired via this route would also mean that Indian SMEs would be able to do business with nations in a more regulated environment with a levelled playing field for both sides. However, if Indian companies limit the philosophy of an Atmanirbhar Bharat only within its domestic bounds, it will significantly restrict SMEs' growth.

Identifying The Right Opportunities

Despite an array of conversations around the topic, the question remains – How does a nation become a global power? A good case study to answer this question can be derived from India's own history as a British colony. Britain's journey to domination in the early years of colonization 1800s was driven by their search for trading opportunities worldwide. The more they moved away from their geographical borders, the more they flourished monetarily. Similarly, it is crucial to recognize that Indian SMEs can only avail opportunities sitting before them if they move away from the domestic borders and do business with countries that can invest in their growth. The EU is not only the country's largest trading partner at present but also its biggest investor. Deepening trade ties with the European Union through the most accessible routes, primarily through investment, can thus help India compete with China on the international front.

There is a strong correlation between the number of investment visas issued and businesses trading in that country. Let us consider an example of an SME operating out of Jaipur who has acquired a residence permit for Portugal via the investment route. The company now gets a home market advantage to trade with Portugal and the other 27 EU countries. As opposed to this, trading in the EU will become significantly more complex for an Indian SME with limited capital and no base in Portugal. Therefore, when we dig deeper into this reality, we can see an emerging pattern that firmly upholds the findings.

Subsequently, evaluating investment trends over the last two decades showcases that there has been limited to no major investment and trade between India and Greece. While Indian businesses have refrained from Identifying the underlying opportunity by developing relations with Greece, international conglomerates like Microsoft and Amazon have already built a solid foothold.

While a more favourable trading environment offered by politically forged trade tied ease operations for Indian businesses, one must understand their fragility. Taking the investment visa route is a sure-shot way of expanding the presence of Indian firms in the European Union and strengthen their position in a nation which is still primarily dominated by the Chinese.

How is Mapping China's consumption of EU's Golden Visa Programs and their SME Trade with Europe

India and China have been pitted against each other owing to their cohesive role in shifting the global power balance to the east. With a significant number of resources and human resources at their disposal, India and China have aided in altering world dynamics socially, economically, and politically. Despite both the nations embarking on different paths towards development, many draw similarities in their affinity towards immigration, wealthy population, and business acumen.

A Deeper Look Into The India Vs China Debate

Indians and Chinese both constitute a significant chunk of the world's immigrant population. Despite this tendency to move abroad, the routes taken by the people from the two countries are poles apart. India has traditionally been a provider of soft services and skilled labour to countries around the world. When we look at this trajectory empirically, we can see that a large number of the Indian diaspora avails a more significant chunk of skilled work visa programs and permits than the Chinese. The manifestation of this trend can be seen in the significantly high work population of Indian origin in countries like Canada, the UK, the US & Australia. The skill-driven migration of talent can be seen in the eventual commercial success of Indians on the global stage, where many lead renowned corporations as their CEOs, CXO's, etc. However, when we look at the investment route, the numbers are severely contrasting. Over the last decade, Indians have contributed less than 10% to the investor visa categories combined.

In contrast, Chinese SMEs have taken up over 50% of the available investment visas in various countries, including Europe. Let’s look at some numbers.

The large-scale foreign investment by the Chinese invariably results in a significant amount of trade between China and the rest of the world. The rise of China as an industrial superpower has revamped global politics. From being the world's factory to the hub of the most advanced technological advancements, it has become the one nation that the world is dependent on for almost everything manufacturing, and tech. China represents approximately 14% of the EU's external trade, nearly seven times India's share. These numbers highlight India's untapped potential.

What Will Happen When India Decides To Take The Investment Route?

A review of the Indian export & import data showcases that 60 percent of trade is conducted by companies valued at under 100 crores, and large conglomerates undertake only 40 percent. Therefore, small & medium enterprises are at the heart of India's economic growth. With the European market being one of the world's largest consumers of tech-based solutions and tech-backed Indian SMEs focused on offering solution-driven products and services - stronger ties with the EU could be a game-changer for both nations.

When Indian SMEs jump on a similar investment visa bandwagon with Europe. In that case, they could fill the existing need gap between the challenge (posed by India’s trade deficits with many countries) and the opportunity (existence of many complimenting products) that stands before them.

India's focus on building an Atmanirbhar Bharat (self-reliant) has given birth to a slew of small and medium enterprises under the 100-crore mark that can trade with Europe by either exporting or importing products/services. Deeper trade ties with the European Union acquired via this route would also mean that Indian SMEs would be able to do business with nations in a more regulated environment with a levelled playing field for both sides. However, if Indian companies limit the philosophy of an Atmanirbhar Bharat only within its domestic bounds, it will significantly restrict SMEs' growth.

Deeper trade ties with the European Union acquired via this route would also mean that Indian SMEs would be able to do business with nations in a more regulated environment with a levelled playing field for both sides

Identifying The Right Opportunities

Despite an array of conversations around the topic, the question remains – How does a nation become a global power? A good case study to answer this question can be derived from India's own history as a British colony. Britain's journey to domination in the early years of colonization 1800s was driven by their search for trading opportunities worldwide. The more they moved away from their geographical borders, the more they flourished monetarily. Similarly, it is crucial to recognize that Indian SMEs can only avail opportunities sitting before them if they move away from the domestic borders and do business with countries that can invest in their growth. The EU is not only the country's largest trading partner at present but also its biggest investor. Deepening trade ties with the European Union through the most accessible routes, primarily through investment, can thus help India compete with China on the international front.

There is a strong correlation between the number of investment visas issued and businesses trading in that country. Let us consider an example of an SME operating out of Jaipur who has acquired a residence permit for Portugal via the investment route. The company now gets a home market advantage to trade with Portugal and the other 27 EU countries. As opposed to this, trading in the EU will become significantly more complex for an Indian SME with limited capital and no base in Portugal. Therefore, when we dig deeper into this reality, we can see an emerging pattern that firmly upholds the findings.

Subsequently, evaluating investment trends over the last two decades showcases that there has been limited to no major investment and trade between India and Greece. While Indian businesses have refrained from Identifying the underlying opportunity by developing relations with Greece, international conglomerates like Microsoft and Amazon have already built a solid foothold.

While a more favourable trading environment offered by politically forged trade tied ease operations for Indian businesses, one must understand their fragility. Taking the investment visa route is a sure-shot way of expanding the presence of Indian firms in the European Union and strengthen their position in a nation which is still primarily dominated by the Chinese.