Mumbai Based Cactus Venture Partners Wants to Invest  630 crore in Startups

630 crore in Startups

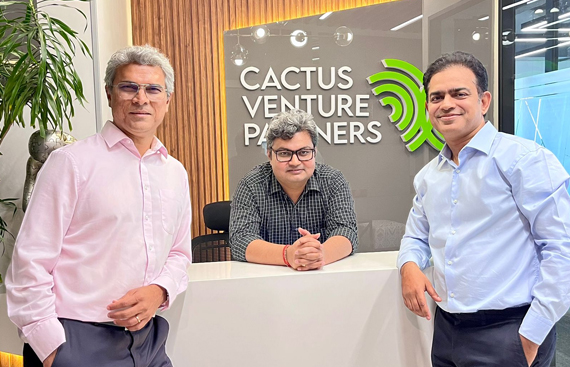

According to general partners Rajeev Kalambi and Amit Sharma, the Company has secured a total amount of  630 crore to invest in eight to 10 startups in the said space, with a cheque size of $2-5 million.The early growth stage venture investment firm is backed by international Limited Partners (LPs) and domestic financial institutions, including the likes of SIDBI, Self-Reliant India Fund (SRI Fund), and the UP Startup Fund.

630 crore to invest in eight to 10 startups in the said space, with a cheque size of $2-5 million.The early growth stage venture investment firm is backed by international Limited Partners (LPs) and domestic financial institutions, including the likes of SIDBI, Self-Reliant India Fund (SRI Fund), and the UP Startup Fund.

According to the statement of the company, sizeable commitments were received from international and domestic Family Offices and Ultra High Net worth Individuals. Their main focus will continue to remain on Series A and early Series B fundraising stages, wherein the team will work closely with the founders to grow the product.

The VC Farm has already funded six companies including Kapture, Vitraya, AMPM, Auric, Lohum, Rubix - and scored one exit. They have received capital commitments from investors, of which 60% originate from domestic sources and the remaining from international limited partners, predominantly from the US, Singapore, European Union, and the UK.

Commenting on the selection process, Sharma mentioned, “The filtering criteria for us is not vertical, its Product-Market Fit (PMF), ie there should be decent gross margins. While a company should also have a significant multiplier in the good market to capitalize, it must have cost levers in place to go through weaker market.”

He further added, "We are in the late stages of evaluation of two companies and will most likely close them in the next 3 months. We are very actively investing this year and will continue to be cognizant of the quality."

Investments by PEs and VC funds as of December 20, 2023, fell to a low of $27.9 billion across 697 transactions against $47.62 billion in 2022 across 1,364 deals. Early-stage funding followed closely with a 70 percent drop, down to $2.2 billion from $7.3 billion, while seed-stage funding saw a decline of 60 percent —from $1.7 billion in 2022 to $678 million in 2023.