Deeptech startup Mindgrove Snags Seed Cheque From Sequoia, Speciale Invest

By Team Startupcity | Thursday, 23 February 2023, 06:37 Hrs

Deeptech firm Mindgrove Technologies said that it has received $2.325 million in seed funding, or roughly Rs 19.5 crore, from Sequoia Capital India. Speciale Invest, Whiteboard Capital, and angel investors Ashwini Asokan (Mad Street Den) and Nischay Goel also participated in the round (Duro Capital).

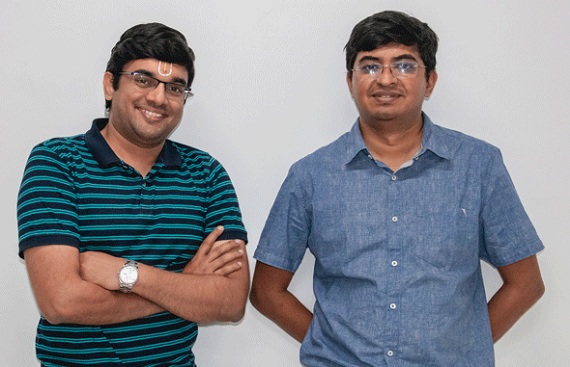

Shashwath T. R. and Sharan Srinivas J. founded Mindgrove in 2021. Mindgrove is a deep-tech firm that specialises in designing system-on-chips (SoCS) for the internet of things (IoT), automotive, consumer electronics, industrial automation, security, and aviation industries.

The business from Chennai intends to use the additional funding to increase recruiting and technological advancement. According to Shashwath, Mindgrove's goal of designing chips in India specifically for the Indian market is in line with the country's requirements for semiconductors. The timing of Mindgrove's investment coincides with an increase in deal activity in India's deeptech sector since last year. Praan, a deep tech firm, raised $1.56 million in a round that was co-led by Social Impact Capital earlier in January.

At the same time frame, Exfinity Venture Partners led a pre-series A funding round in which Bengaluru-based Chara Technologies raised $4.75 million (or roughly Rs 39 crore). Sequoia Capital India has also been investing in a sizable number of early-stage deals. Sequoia Capital India has funded businesses including Byjus, CRED, Freshworks, Groww, Mamaearth, Pine Labs, Razorpay, Truecaller, and Zomato among others.

Software-as-a-service (SaaS) startup Hatica received $3.7 million in venture funding in February from the company through its accelerator programme Surge. It also oversaw Freightify's $12 million Series A investment round over the same time frame. 71 agreements were completed by the VC firm last year, according to data from the market analytics platform Venture Intelligence, which shows that it dominated venture capital investments in India in 2022.