Razorpay partners with Mastercard to assist banks with recurring Payments

Razorpay has partnered with Mastercard to create a recurring payments platform that will assist banks in complying with the Reserve Bank of India's new guidelines.

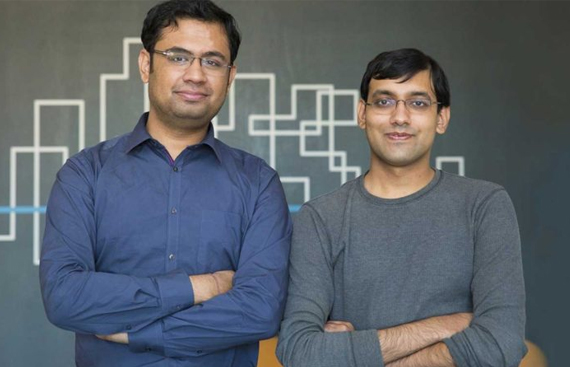

Harshil Mathur and Shashank Kumar, both IIT Roorkee alumni, founded Razorpay in 2014. Only a few years later, Razorpay has grown into an 800-person organisation with some of the best talent in the country, assisting some of the best companies in seamlessly managing their money movement.

The RBI has extended the deadline for banks to comply with the new rules, which include providing customers with a consent notification every time a recurring payment is debited, as well as the option to opt out, until September.

The RBI rule states that Additional Factor of Authentication (AFA) must be made mandatory for all recurring transactions on debit cards, credit cards, Unified Payments Interface, and other Prepaid Payment Instruments that are less than Rs 5,000.

Razorpay's Mandate HQ platform aims to capture a significant share of India's subscription, online post-paid recharge, and bill payment market, according to Razorpay co-founder and chief executive Harshil Mathur.

Currently, BillDesk offers a similar service in collaboration with Visa.

“With RBI increasing the limit for AFA to Rs 5,000 (from Rs 2,000 earlier), we believe the size of the recurring mandate-based payments market will grow 5-6 times in the next few years,” said Mathur. “This was viewed as a grey area earlier, but RBI’s regulations give clarity to consumers, merchants as well as banks.”

As a result, the RBI extended the deadline, even though BillDesk's SI Hub was on its way to a virtual monopoly in the recurring payments space.

According to Mathur, Razorpay's Mandate HQ will enable banks to fully integrate their functionalities with the platform in seven days, which is significantly faster than the industry standard of a few weeks. He went on to say that the platform is built on API-based plug-and-play technology.

Mastercard and Razorpay have currently enabled integrations for three leading banks and are in discussions with over 20 others to help integrate this technology into their existing payment infrastructure in the coming weeks, according to Mathur.

“It will enable all the partner banks to seamlessly adapt the new framework for recurring payments via debit and credit cards, UPI and other prepaid payment instruments, in compliance with RBI’s new mandate and ensure that bank customers can continue to enjoy hassle-free payments,” said Rajeev Kumar, senior vice president, market development, South Asia, Mastercard.