Sector-Specific Mutual Funds: How Do They Work And Who Should Invest In Them?

Sector-specific funds offer a unique investment opportunity as they have the potential for high growth when the particular sector is experiencing a boom. However, many investors may not be aware of sectoral funds or may be unwilling to invest in them due to a lack of knowledge. In this article, we will take a look at what sector-specific mutual funds are, how they work, and who should be investing in them.

What are sector-specific mutual funds?

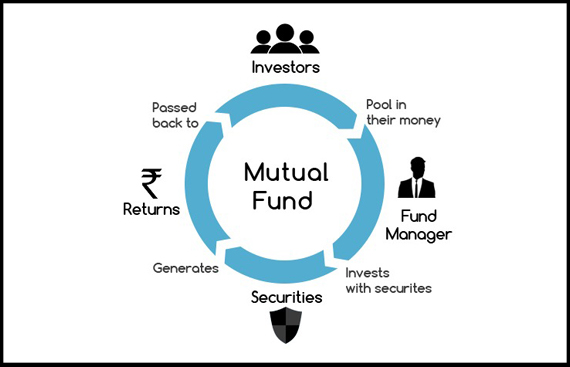

As the name implies, sector-specific mutual funds or sectoral funds are a type of mutual fund investment where the majority of the assets are invested in the stocks of publicly listed companies from a single industry or sector. For instance, a healthcare mutual fund would invest primarily in companies related to medicine and healthcare, or a technology mutual fund would invest majorly in technology and IT companies.

Some of the common types of sectoral funds include financial sector funds, healthcare sector funds, defence sector funds, infrastructure funds, and many more. These sectoral funds are managed by a dedicated fund manager with in-depth knowledge of the sector, working under a fund house. Fund managers look at the industry trends, company fundamentals, and the latest news and updates to decide which companies to invest in through their sector fund.

Why invest in sector funds?

The primary reason to invest in sector-specific funds is due to the potential for high returns. When a specific sector or industry experiences a period of economic boom, then sector funds can deliver exceptionally high returns. For instance, the IT industry in the late 1990s and early 2000s saw a significant boom, leading to the prices of IT company stocks growing rapidly. Similarly, in recent years, the healthcare sector has seen a major boom since the onset of the COVID-19 pandemic.

Sector funds also serve as a way for investors to align their portfolios with their economic beliefs. If an investor believes that the government will work significantly toward boosting infrastructure, then they can invest in an infrastructure mutual fund to capitalise on the potential growth. Moreover, sector funds also allow investors to gain more diversification within a specific industry, as the fund manager picks multiple curated companies to invest in.

Who should invest in sector-specific mutual funds?

While sector-specific mutual funds do offer the potential for high returns, they also come with higher risks. Since the investments are focused on a single sector, they can be more volatile than other types of mutual funds. If the sector underperforms, it can negatively impact all of the stocks in the sectoral mutual fund. Regulatory changes from the government can also impact a sector fund significantly.

Thus, it is recommended that only experienced investors should consider investing in sector-specific mutual funds. People who are experts in any specific industry can also invest in the sector funds they are familiar with, by understanding and predicting when the sector is going to experience a boom.

Moreover, investors who have a large risk appetite and are investing for the long term can also choose to invest in sector funds with proper research. For investors who have a very centralised portfolio, investing in sector-specific funds can be a way of diversifying their portfolio. However, it can be a good idea to consult with a financial advisor before you start investing in a sector fund.

To conclude

Sector-specific mutual funds that invest in a specific industry may have the potential to bring high returns, but they also pose high risks. These funds can offer high growth when the specific sector or industry is booming but may offer poor or negative returns when the industry is experiencing a downturn. Experienced investors and sector experts should consider investing in these funds. Sector funds can also be a way through which investors can diversify their portfolios, but investors must do their due diligence before investing in them.