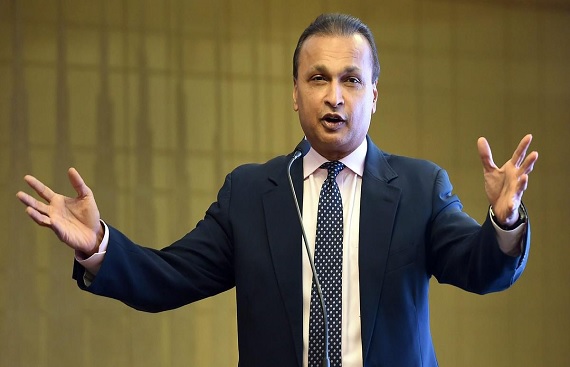

SBI Reclassifies RCom and Anil Ambani as 'Fraud', Rs 3,000 Crore Exposure

By

siliconindia | Tuesday, 22 July 2025, 08:43 Hrs

- SBI reclassifies RCom and Anil Ambani as 'fraud' after following revised RBI guidelines issued in July 2024.

- Rs 3,000+ crore exposure includes fund-based dues and bank guarantees, complaint to CBI is in progress.

- Earlier fraud tag reversed after Supreme Court ruling; reclassification done with due process under IBC.

In a major development, the State Bank of India (SBI) has once again classified Reliance Communications Limited (RCOM) and its Promoter Director Anil D. Ambani as 'fraud' entities, in line with the Reserve Bank of India’s (RBI) guidelines. This was confirmed by Minister of State for Finance Pankaj Chaudhary in a written reply to the Lok Sabha.

The classification was officially reported to the RBI on June 24, 2025, and the bank is in the process of filing a complaint with the Central Bureau of Investigation (CBI). The disclosure was also made to the Bombay Stock Exchange by RCOM’s Resolution Professional on July 1, 2025, as part of regulatory compliance.

The minister revealed that SBI's total credit exposure to RCOM includes a fund-based principal outstanding of Rs 2,227.64 crore, along with accrued interest and expenses since August 26, 2016, in addition to non-fund-based bank guarantees worth Rs 786.52 crore.

RCOM has been undergoing Corporate Insolvency Resolution Process under the Insolvency and Bankruptcy Code (IBC), 2016. The Committee of Creditors approved a resolution plan, which was filed with the National Company Law Tribunal (NCLT), Mumbai on March 6, 2020, and is currently awaiting final approval.

Further, the bank has also initiated Personal Insolvency Proceedings against Anil Ambani under IBC, which is being heard by the NCLT, Mumbai, Chaudhary informed.

Interestingly, this is not the first time RCOM and Anil Ambani have been classified as fraud by SBI. The bank had previously done so on November 10, 2020, and filed a complaint with the CBI on January 5, 2021. However, the complaint was returned due to a Delhi High Court 'status quo' order dated January 6, 2021.

Subsequently, the Supreme Court’s March 27, 2023 ruling in the SBI vs Rajesh Agarwal case made it mandatory for lenders to give borrowers an opportunity to present their case before being labelled as fraud. SBI reversed the earlier classification on September 2, 2023, but restarted the process in line with a revised RBI circular issued on July 15, 2024.

After completing the due process, the account was reclassified as 'fraud', and further legal actions are now underway.