RBI plans to link credit cards to UPI, starting with Rupay cards

By

siliconindia | Wednesday, 08 June 2022, 08:54 Hrs

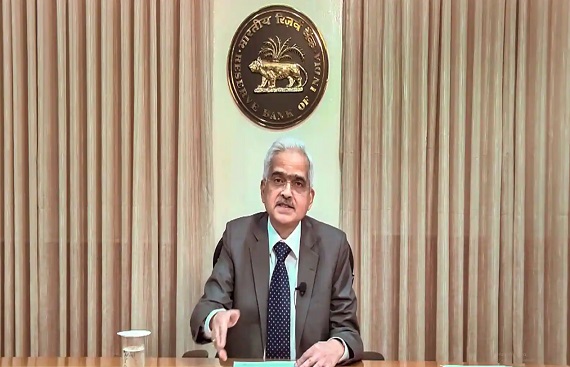

The Reserve Bank of India (RBI) on Wednesday proposed to link credit cards to UPI platforms, beginning with Rupay cards, governor Shaktikanta Das announced as the monetary panel voted for another rate hike to control inflation.

At present, UPI facilitates transactions by linking savings or current accounts through users' debit cards.

Das said the new arrangement is expected to provide more avenues and convenience to the customers in making payments through UPI platforms.

UPI has become the most inclusive mode of payment in India, with over 26 crore unique users and 5 crore merchants onboarded on the platform, he added.

In May, 594.63 crore transactions amounting to ₹10.40 lakh crore were processed through UPI, Das said.

The interoperability of prepaid payment instruments (PPIs) has also facilitated access of PPIs to the UPI payment system for undertaking transactions, Das said.

The governor has also announced to raise the e-mandate for recurring payments on cards sharply with limit enhanced from ₹5,000 to ₹15,000 per transaction.

The RBI has raised the key lending rate by 50 basis points to 4.90%, Shaktikanta Das announced, adding that the MPC is focused on withdrawal of accommodation.

Wednesday's increase follows a 40-bps rise in early May at an unscheduled meeting that kicked off the central bank's tightening cycle, which economists expect to be relatively short.

The war in Ukraine is lingering and India is facing new challenges everyday, accentuating supply chain problems, Das said. The war has led to globalisation of inflation, he said.

"Upside risks to inflation as highlighted in last policy meetings have materialized earlier than expected," Das said after the policy decision.

He said inflation will likely remain above the RBI's upper tolerance band in the first three quarters of the financial year that started on April 1.

Retail inflation in April accelerated to 7.79% from a year earlier, above the RBI's tolerance band for inflation of 2% to 6% for a fourth month in a row, and a further rise in global prices of crude oil, food and other commodities is expected to keep up the upward pressure.

The price spikes have hammered consumer spending and darkened the near-term outlook for India's economic growth, which slowed to the lowest in a year in the first three months of 2022.

The central bank maintained its growth projection at 7.2% for FY23.