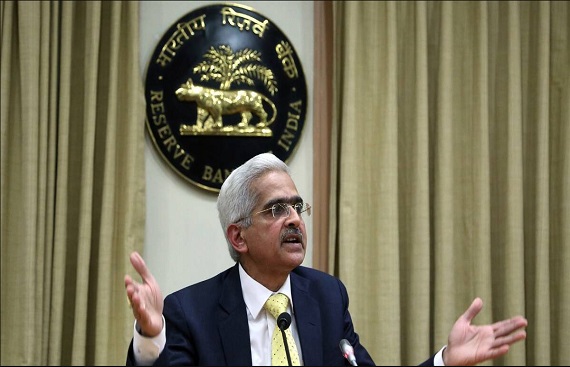

RBI governor Shaktikanta Das rolls out UPI for feature phones

By

siliconindia | Tuesday, 08 March 2022, 12:16 Hrs

Reserve Bank of India (RBI) governor Shaktikanta Das on 8 March rolled out Unified Payments Interface (UPI) for feature phones, saying the move will bump up digital adoption, and launched a 24x7 helpline for digital payments known DigiSaathi.

UPI 123Pay will permit customers to use feature phones for almost all transactions except scan and pay. It doesn't need internet connection for transactions. Customers have to link their bank account with feature phones to use this facility.

UPI on feature phones will help people in rural areas who cannot afford a smartphone to participate in UPI transactions, Das said. "This current decade will witness a transformative shift in the digital payments ecosystem in the country," he said, adding the RBI has announced several measures in the last three years to push digital transactions.

Also, Das stressed the requirement to focus on cybersecurity and said systems need to be prepared to face such cyber risks.

The move comes after the central bank in December announced a plan to introduce UPI in feature phones, which has remained confined to smartphones as a payment platform ever since rolling out in 2016, limiting its use among people in rural areas having feature phones.

Since the UPI payment platform was introduced in 2016, transactions have grown multifold.