Private Sector Subscribers Under NPS Cross Over 12 Lakh in FY25

By

siliconindia | Wednesday, 23 April 2025, 04:52 Hrs

The National Pension System (NPS) has achieved a new milestone, as more than 12 lakh fresh private sector subscribers have enrolled themselves in the scheme in the financial year 2024-25. This hike has taken the total number of subscribers to more than 165 lakh as on March 2025, which indicates a rise in the uptake of NPS as a chosen retirement planning solution by private individuals.

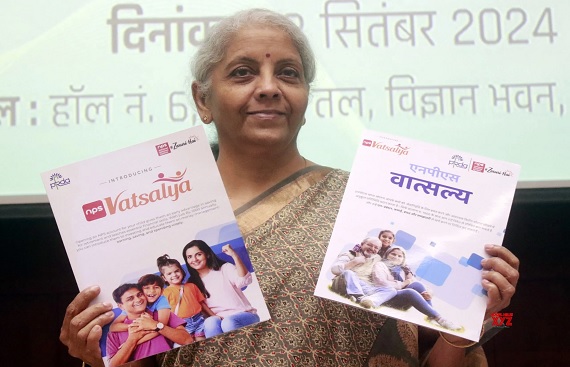

One of the major drivers of this expansion has been the launch of NPS Vatsalya, a scheme rolled out in September 2024 with a focus specifically on children. This scheme has witnessed resounding success, enrolling over one lakh new members in a short time, further cementing the concept of early retirement planning for the younger population.

Along with NPS, the Atal Pension Yojana (APY) too has witnessed considerable growth, adding 11.7 million new enrollments during the same time. With this increase, total enrollments in APY had crossed 76 million as of March 2025. Importantly, this is the third year in succession when APY has added more than 10 million subscribers in a year, which speaks volumes about the scheme's sustained popularity.

The Atal Pension Yojana (APY), now in its tenth year, still provides its subscribers with a guaranteed pension every month of between Rs 1,000 to Rs 5,000 from the age of 60. The scheme promises that subscribers will get a guaranteed pension amount for life upon crossing the age barrier of 60. Upon the death of the subscriber, his or her spouse still gets the same pension. Additionally, if both the subscriber and their partner pass away, the accumulated pension wealth, up to the subscriber's 60th year, is refunded to the nominee, giving extra protection to families.

Both the NPS and APY have had outstanding financial performance, as the combined Assets Under Management of both schemes increased by 23% to Rs 14.43 lakh crore by March 2025. This good growth trend reflects the growing importance of both the NPS and the APY in retirement planning and long-term savings.

From a performance perspective, APY has provided a consistent high annual return of 9.11%, making it a trusted retirement product for most Indians. The new enrollment demographic is indicative of a high degree of gender inclusivity, with women contributing to around 55% of new subscribers in FY25, reflecting increased financial awareness and engagement among women.

To simplify and enhance accessibility, the Pension Fund Regulatory and Development Authority (PFRDA) made a few reforms this year. In the previous year, the procedure to open APY accounts was increased by providing the facility to select three Central Recordkeeping Agencies (CRAs), namely CAMS, KFin, and Protean eGov Technologies, to initiate and keep accounts. In addition, contributions to APY are now also accepted through an auto-debit system from the bank accounts or post-office savings accounts of subscribers, thereby making it easier.

In an effort to increase outreach and enhance awareness, PFRDA organized 32 APY Outreach Programs across India during FY25. These programs, jointly with State Level Bankers' Committees (SLBCs) and Lead District Managers (LDMs), involved training programs for bank officials and public awareness campaigns. These efforts have been the key drivers of APY growth and popularity, enabling more Indians to secure their future by means of safe, government-guaranteed pension schemes.

Both APY and NPS remain a mainstay of financial security for millions of Indians, and the growing subscriber list is a self-evident indication of how rising trust and dependence on pension schemes as part of long-term financial planning continues to grow.