Pre-Existing Diseases in Health Insurance: All You Should Know

Pre-existing diseases mean any illness or medical condition that a policyholder is suffering from before the purchase of the health insurance policy. Pre-existing diseases in Health Insurance can range from chronic diseases such as diabetes, heart disease, and cancer to some other illnesses, such as allergies, asthma, and high blood pressure. When buying a health plan, it is important to disclose all the pre-existing illnesses to the insurance company. Early disclosure of pre-existing diseases helps in the right assessment of risk and understanding the policy terms and conditions, inclusions and exclusions.

Importance of Disclosing Pre-Existing Conditions

- Insurance companies can reject your claims on technical grounds due to non-disclosure.

- It is essential to determine the adequate and accurate premium amount considering the risk.

- It helps initiate the waiting periods faster.

- It helps get guidance and support from the insurance company on how these pre-existing diseases can be included or excluded.

- Early disclosures help avoid future disputes and confusion.

- Disclosures in previous policies help to retain the accrued waiting period while switching a policy.

- Transparency in the beginning helps you make informed decisions.

Steps to Purchase Health Insurance with Pre-Existing Disease

Step 1: Research and Compare Plans

With the help of the available online tools, the different policies can be compared based on coverage, premium, waiting periods, network of hospitals, reviews, etc.

Step 2: Check the Insurer's Claim Settlement Ratio

Choose an insurance company provider with a high claim settlement ratio.

Step 3: Review Policy Exclusions

For a healthy claim settlement, review the policy initially carefully to get an idea about what is excluded.

Step 4: Consult with an Insurance Advisor

Depending on the health requirements, consult an insurance advisor.

Step 5: Read the Fine Print

Read through all the terms and conditions, including coverage, waiting period, co-payment clauses, etc.

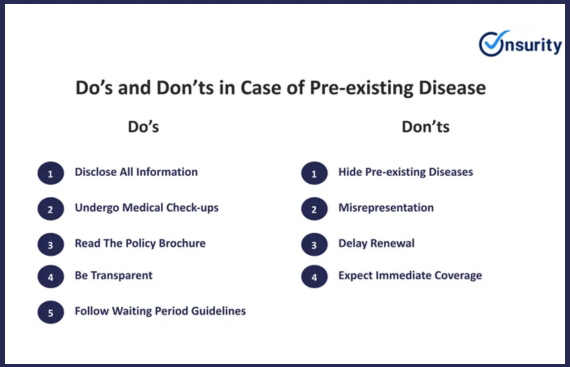

Do’s and Don’ts in Case of any Pre-Existing Diseases in Health Insurance

Do’s

- When buying a policy, disclose all pre-existing diseases, if any.

- Compare all policies available and select the best amongst them.

- In case an insurer demands, get a free medical check-up done.

- Go through the insurance policies diligently to avoid any confusion in future.

Don’ts

- Do not hide your pre-existing diseases to avoid a higher amount of premium.

- Do not avoid reading the waiting period information in the policy document.

- Once the policy is purchased, still do not skip your medical tests.

- Do not presume all insurance policies will deal in the same manner.

Conclusion

Disclosing pre-existing diseases is essential before applying for a health insurance plan; failing to do so can result in the denial of the claim or cancellation of the policy. Early disclosure of pre-existing diseases helps insurance companies assess the risks accurately to provide coverage, affecting the premium costs. Apart from pre-disclosure, any new diagnosis during the policy tenure, medication changes, surgeries, or hospitalisation must also be informed, failing which would result in denial of the claim or cancellation of the policy.