How APAC Economies Tackle U.S. Trade Policies

The evolving trade dynamics between India and the United States present challenges and opportunities. The ongoing negotiations and potential trade agreements are expected to shape the future of bilateral trade relations and contribute to the economic growth of both nations.

India’s overall exposure to the United States is lower relative to other economies in the Asia-Pacific (APAC) region. However, specific sectors, including food, textiles, and pharmaceutical products, face heightened risks. The agency noted that most companies within its rated portfolio are primarily domestic-focused, with limited exposure to the U.S. market.

To mitigate pressures arising from reciprocal tariffs, the United States and India are reportedly engaged in discussions aimed at reducing import tariffs on select U.S. products, expanding market access for U.S. agricultural goods, and increasing purchases of U.S. energy. These negotiations are expected to lay the groundwork for a potential trade agreement by the fall of 2025.

Among APAC economies, developing nations such as India, Vietnam, and Thailand exhibit some of the broadest interest rate differentials relative to the United States. The most exposed sectors include electronics, motor vehicles, food, and textiles. Beyond the adverse impact of weaker export demand, a significant challenge for emerging markets in the region is the increasing difficulty in pursuing an export-led growth strategy amid an evolving and interventionist global trade environment.

U.S. President Donald Trump has announced plans to impose reciprocal tariffs on trading partners, including India. The current U.S. administration has enacted additional tariffs, including a 10 percent levy on imports from China and a 25 percent tariff on steel and aluminum.

It is also observed that while the United States is a net exporter of food, feeds, and industrial supplies to the APAC region, it remains a net importer of capital goods, automotive vehicles and parts, and consumer goods. Reciprocal tariffs are expected to affect several key APAC sectors reliant on U.S. final demand, including computer and electronic products, chemicals, motor vehicles, food, textiles, and wood products.

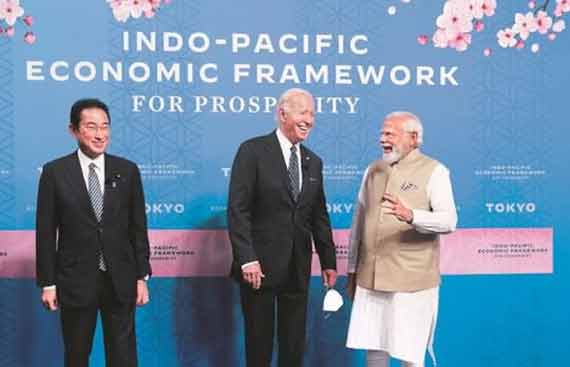

India and the United States have underscored the significance of global trade and economic expansion in driving India's growth. Both nations have committed to doubling bilateral trade to $500 billion by 2030 and finalizing the initial phase of a comprehensive multi-sector trade agreement by fall 2025. Additionally, India is actively engaging in bilateral trade negotiations with key partners, including the United Kingdom and the European Union, to establish free trade agreements.

The policy response across APAC will be critical in determining the ultimate impact on credit strength. It further noted that regional governments will likely adopt a pragmatic approach to prevent further trade escalations with the US by prioritizing bilateral negotiations, as evidenced by recent developments.