Government Increases PF Withdrawal Limit to Rs 1 Lakh

By

siliconindia | Wednesday, 18 September 2024, 04:18 Hrs

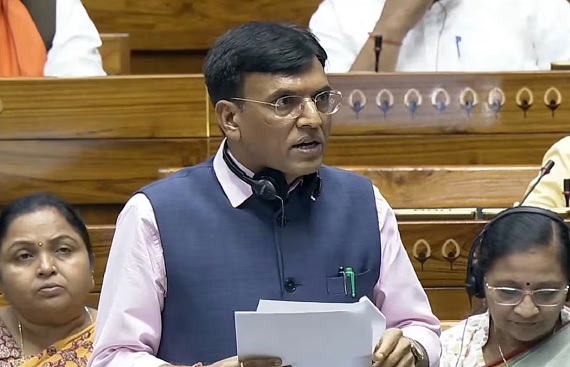

Union Labour Minister Mansukh Mandaviya announced that the withdrawal limit for subscribers of the Employees' Provident Fund Organisation (EPFO) has been increased to Rs 1 lakh, up from the previous cap of Rs 50,000. This change allows individuals to access more funds from their provident accounts for personal financial needs.

The labor ministry has also introduced a new digital framework and updated guidelines to improve flexibility and responsiveness within the EPFO, reducing subscriber inconveniences. Notably, the restriction on withdrawing funds before completing six months in a job has been lifted, enabling new employees to access their savings sooner.

“People often rely on their EPFO savings for major expenses like weddings and medical treatments. We have raised the withdrawal limit to Rs 1 lakh to better meet these needs”. Mandaviya stated during the government's 100-day office celebration. The previous limit had become outdated due to evolving consumption patterns.

Provident funds are a crucial retirement savings mechanism for over 10 million employees in the organized sector, serving as a primary source of lifetime savings for many. The EPFO's interest rate for FY24, set at 8.25%, remains a critical benchmark for the salaried middle class.

In a notable policy shift, the government is now allowing organizations not previously part of the EPFO to transition to the State-run retirement fund manager. Some companies, due to an exemption granted for funds established before the EPFO's inception in 1954, can run their own private retirement schemes.

“There are 17 such companies with a combined workforce of 100,000 and a corpus of Rs 1,000 crore. If they choose to switch to EPFO, they will be permitted to do so, as EPFO offers better and more stable returns”, Mandaviya explained. Companies like Aditya Birla Ltd have reportedly approached the government seeking this transition, prompting the policy adjustment.

Looking ahead, the government is working on increasing the income threshold for mandatory provident fund contributions, which currently stands at Rs 15,000 for salaried employees. The threshold for Employees’ State Insurance, presently at Rs 21,000, will also be revised.

Mandaviya noted that employees earning above Rs 15,000 will have the option to decide how much of their income they wish to allocate toward retirement benefits and pension.

Under the Employees’ Provident Funds and Miscellaneous Provisions Act of 1952, companies with 20 or more employees are mandated to contribute to provident funds. This includes a compulsory deduction of at least 12% of an employee’s salary, with an equal contribution from the employer.

The recent policy changes reflect the government’s ongoing efforts to enhance retirement savings accessibility and adaptability in response to the needs of the workforce.