All you need to know about RBI's latest policies

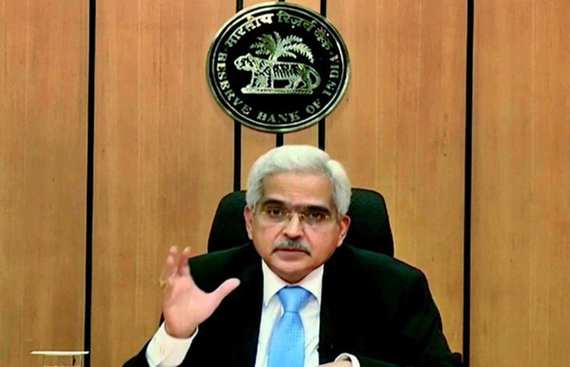

The Reserve Bank of India (RBI) concluded its Bi-monthly Monetary Policy address on Thursday afternoon. The review meeting presided over by the Six- member monetary policy committee (MPC) was headed by RBI Governor Shaktikanta Das.

Here are some of the key points to note down on RBI's latest policy review:

Priority sector lending status to start-ups

Priority Sector Lending (PSL) is a tool given by the RBI to the banks for providing a specified portion of the bank lending to few specific sectors like agriculture and allied activities, micro and small enterprises, poor people for housing, students for education and other low-income groups and weaker sections of the society.

RBI has given priority sector lending status to start-ups in a significant drift from its usual lending norms. This will enable thousands of start-ups to function in different fields to access timely and adequate bank credit. RBI Governor Shaktikanta Das said that the PSL policies had been reviewed in view of emerging national priorities and to bring sharper focus in inclusive development.

"An incentive framework is now being put in place for banks to address the regional disparities in the flow of priority sector credit." "PSL status is also being given to start-ups; and the limits for renewable energy, including solar power and compressed bio-gas plants, are being increased," says Shaktikanta Das.

RBI retains lending rates

The Reserve Bank of India, on Thursday afternoon, announced that it is going to retain key short-term lending rates but maintain a growth-oriented accommodative stance.

The Monetary Policy Committee of the central bank maintained the repo rate or short-term lending rate for commercial banks, at 4 percent. Likewise, the reverse repo rate stands unchanged at 3.35 percent. The MPC voted to maintain an accommodative stance, thus opening up possibilities for more future rate cuts. Similarly, the marginal standing facility (MSF) rate and the 'Bank Rate' remain unchanged at 4.25 percent.

"The MPC sifted through domestic and global conditions and evaluated their unfolding impact on overall outlook for India and the world," RBI Governor Shaktikanta Das said. He further pointed out that at the end of its deliberations, the MPC voted unanimously to leave the policy repo rate unchanged at 4 percent and continue with the accommodative stance of monetary policy as long as necessary revive growth, while ensuring that inflation remains within the target.

RBI allows higher loans against gold ornaments and jewelry

The Reserve Bank of India added additional glitter to gold ornaments and jewelry by allowing banks to give loans up to 90 percent of the total value pledged by borrowers. At present, loans sanctioned by banks against pledge of gold ornaments and jewelry is up to 75 percent of the value of such items.

The RBI has sent circulars to all commercial banks in regards to the decision stating: "With a view to further mitigate the economic impact of the Covid-19 pandemic on households, entrepreneurs and small businesses, it has been decided to increase the permissible loan to value ratio (LTV) for loans against pledge of gold ornaments and jewelry for non-agricultural purposes from 75 per cent to 90 per cent,"

Special resolution window for COVID linked stress

The Reserve Bank of India (RBI) has decided to provide a special window under its 'prudential framework for resolving stressed assets' for COVID-related stress, wherein lenders can implement a resolution plan without changing ownership to prescribed conditions.

In a video address posted by the Monetary Policy Committee's (MPC), the Reserve Bank of India Governor said that the move had been announced in a bid to provide relief to stressed companies which have not been able to repay loans due to cash flow issues amid the pandemic.

The RBI Governor Shaktikanta Das said, "It has been decided to provide a window under the Prudential Framework to enable the lenders to implement a resolution plan in respect of eligible corporate exposures without change in ownership, and personal loans, while classifying such exposures as Standard subject to specified conditions." He noted that the economic fallout on account of the Covid-19 pandemic has led to significant financial stress for several borrowers. In light of past experiences concerning the use of regulatory forbearances, necessary safeguards are being incorporated, including prudent entry norms, clearly defined boundary conditions, specific binding covenants, independent validation, and strict post-implementation performance monitoring.

Read More News :

E-Commerce Trends That Will Shape Your Business In The Future

.jpg)