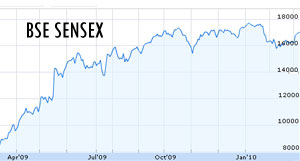

Sensex crosses 17,000 for first time in 16 months

By

siliconindia | Wednesday, September 30, 2009

Mumbai: Buying in selected frontline stocks in anticipation of strong quarterly earnings helped the Sensex hit the 17000 levels for the first time in 16 months. Banking, auto and metal stocks were leading the gains. The benchmark index of the Bombay Stock Exchange had last crossed the 17,000 mark on May 23, 2008.

The Sensex, which opened at 16,868.46 points closed at 17,126.84 points, up 273.93 points or 1.63 percent higher than its previous close.While, the broader S&P CNX Nifty of the National Stock Exchange ended at 5,083.95 points, 1.54 percent higher than its previous close at 5,006.85 points. The chart showing the 52 week performance of Sensex is on the left.

Broader market indices were also in the green with the BSE midcap index ruling 0.95 percent higher and the BSE smallcap index up 0.94 percent.

Among the Sensex stocks, SBI and ICICI Bank led the gainers, advancing five percent and 4.6 percent respectively. Auto stocks M&M and Maruti advanced over three percent each. Sterlite India also gained over three percent. On the losing side, ITC and ONGC ended over one percent lower. The Bharti stock was little changed at  418. The deadline for exclusive talks between Bharti and MTN ends today.

Asian stock markets were mixed on Wednesday as a surprise drop in U.S. consumer confidence sowed new doubts about the pace of economic recovery. European shares gained modestly in early trade.

Caution over an appreciating yen and a slew of key economic indicators damped gains in Japanese stocks while China posted a solid rise on the last day of trading before a weeklong holiday. Wall Street fell on Tuesday after the Conference Board said its consumer confidence index fell in September. Economists had been expecting a reading of 57; instead it came in at 53.1.

The private research group said consumers are still worried about losing their jobs. Many analysts warn a turnaround in the economy won't hold unless consumer spending picks up and employers add jobs.

418. The deadline for exclusive talks between Bharti and MTN ends today.

Asian stock markets were mixed on Wednesday as a surprise drop in U.S. consumer confidence sowed new doubts about the pace of economic recovery. European shares gained modestly in early trade.

Caution over an appreciating yen and a slew of key economic indicators damped gains in Japanese stocks while China posted a solid rise on the last day of trading before a weeklong holiday. Wall Street fell on Tuesday after the Conference Board said its consumer confidence index fell in September. Economists had been expecting a reading of 57; instead it came in at 53.1.

The private research group said consumers are still worried about losing their jobs. Many analysts warn a turnaround in the economy won't hold unless consumer spending picks up and employers add jobs.

Source: IANS

418. The deadline for exclusive talks between Bharti and MTN ends today.

Asian stock markets were mixed on Wednesday as a surprise drop in U.S. consumer confidence sowed new doubts about the pace of economic recovery. European shares gained modestly in early trade.

Caution over an appreciating yen and a slew of key economic indicators damped gains in Japanese stocks while China posted a solid rise on the last day of trading before a weeklong holiday. Wall Street fell on Tuesday after the Conference Board said its consumer confidence index fell in September. Economists had been expecting a reading of 57; instead it came in at 53.1.

The private research group said consumers are still worried about losing their jobs. Many analysts warn a turnaround in the economy won't hold unless consumer spending picks up and employers add jobs.

418. The deadline for exclusive talks between Bharti and MTN ends today.

Asian stock markets were mixed on Wednesday as a surprise drop in U.S. consumer confidence sowed new doubts about the pace of economic recovery. European shares gained modestly in early trade.

Caution over an appreciating yen and a slew of key economic indicators damped gains in Japanese stocks while China posted a solid rise on the last day of trading before a weeklong holiday. Wall Street fell on Tuesday after the Conference Board said its consumer confidence index fell in September. Economists had been expecting a reading of 57; instead it came in at 53.1.

The private research group said consumers are still worried about losing their jobs. Many analysts warn a turnaround in the economy won't hold unless consumer spending picks up and employers add jobs.