10 Stocks I Would Want to Leave For My Grandchildren

By

siliconindia | Friday, November 4, 2011

Is this for real?

'Are such gains for real?' you may ask. 'Such stocks might be really hard to find, right?'

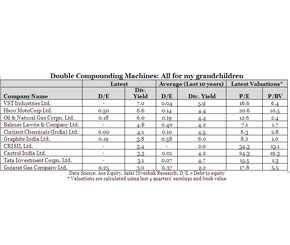

Indeed, it's hard to find such stocks. But then here is a list of stocks that have been 'double compounding machines' in the past, and still pay high dividends.

As you can see from the table above, these stocks have had high dividend yields over the past 10 years, and still sport a high number.

What is more, I have included only those companies in this list that have not taken large debt/borrowings on their books in the past (as seen from their low or nil debt-to-equity ratios), and they don't have high borrowings even now.

How this filter of low debt-to-equity helps is that it removes companies that might have taken bank loans and other borrowings in the past to pay consistent dividends to shareholders (largely to maintain a good image), which is not a shareholder-friendly policy.

Anyways, if you are confused about the term 'dividend yield', it is simply the amount of divided you earn from the stock divided by the price you paid for the stock.

So if you bought a stock for

'Are such gains for real?' you may ask. 'Such stocks might be really hard to find, right?'

Indeed, it's hard to find such stocks. But then here is a list of stocks that have been 'double compounding machines' in the past, and still pay high dividends.

As you can see from the table above, these stocks have had high dividend yields over the past 10 years, and still sport a high number.

What is more, I have included only those companies in this list that have not taken large debt/borrowings on their books in the past (as seen from their low or nil debt-to-equity ratios), and they don't have high borrowings even now.

How this filter of low debt-to-equity helps is that it removes companies that might have taken bank loans and other borrowings in the past to pay consistent dividends to shareholders (largely to maintain a good image), which is not a shareholder-friendly policy.

Anyways, if you are confused about the term 'dividend yield', it is simply the amount of divided you earn from the stock divided by the price you paid for the stock.

So if you bought a stock for  100, and it pays you

100, and it pays you  5 per share as dividend, your divided yield is 5 percent. For such a stock, you are earning a 5 percent return (or yield) even if the stock price doesn't move at all.

5 per share as dividend, your divided yield is 5 percent. For such a stock, you are earning a 5 percent return (or yield) even if the stock price doesn't move at all.

100, and it pays you

100, and it pays you  5 per share as dividend, your divided yield is 5 percent. For such a stock, you are earning a 5 percent return (or yield) even if the stock price doesn't move at all.

5 per share as dividend, your divided yield is 5 percent. For such a stock, you are earning a 5 percent return (or yield) even if the stock price doesn't move at all.