Tips to do Safe Mobile Banking

By

siliconindia | Monday, August 29, 2011

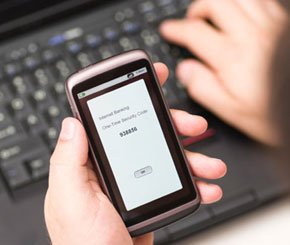

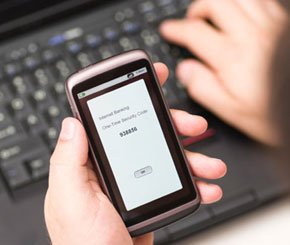

Bangalore: Talking of mobile banking in India, it is still in its infancy stage. With the convenience offered and the number of mobile phone users in India, mobile banking is bound to pick up. Imagine you are trying out an exclusive outfit and you want to buy it that very moment. You have the card ready to make the payments, but a single doubt still lingering in your mind, "whether your mortgage payment is clear"? In such cases mobile banking comes handy. You can use your smart phone and check your balance using your bank's app, and maybe make a quick transfer between accounts.

It is true that mobile banking saves you from those bank trips for every small little thing. But before you get lured by the convenience and the ease that mobile banking services provide, make sure that you know everything about the service or else you could be unlucky like Samad.

Samad a 26-year-old Delhi-based engineer planned to set up a mineral water plant in Uttaranchal, and that required him to visit a lot of cities. He was in and out of the funds almost three times a week. With no time to physically visit a bank, he was transacting primarily through his Blackberry phone via mobile banking service. Samad had this bad habit of forgetting his mobile banking pin. To put an end to this issue, he decided to store his m pin details in his phone. But he had never thought that this mistake could cost him a fortune. He lost his phone at the airport on his way back to Delhi only, to discover later that his bank account, which had a hefty six-digit amount in the morning, was left with zero balance.

Here are some tips for safe mobile banking

Stock up on Passwords

When considering using a mobile payment system, look for as many security features as possible. For instance, a mobile-payment app that offers protection through a PIN number and password can be more secure than an app that requires only one of the two. Users should make sure their phone and its subscriber identity module, or SIM. Change all of your account login information regularly so that it gets difficult for the third person to access your account. Keep changing your passwords and login information regularly and make sure you keep a track of changes made.

When considering using a mobile payment system, look for as many security features as possible. For instance, a mobile-payment app that offers protection through a PIN number and password can be more secure than an app that requires only one of the two. Users should make sure their phone and its subscriber identity module, or SIM. Change all of your account login information regularly so that it gets difficult for the third person to access your account. Keep changing your passwords and login information regularly and make sure you keep a track of changes made.