Piramal Healthcare shares tumble 12 percent

By

siliconindia | Friday, May 21, 2010

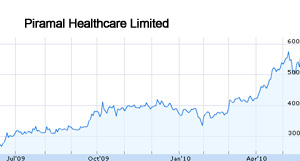

Mumbai: The Piramal Healthcare stock went down nearly 12 percent after the announcement that pharmaceuticals major Abbott will acquire Piramal's formulations business for $3.72 billion. Having started the day at  576.20, the stock touched its 52 week high of

576.20, the stock touched its 52 week high of  599.90, before collapsing to close trade at

599.90, before collapsing to close trade at  502.35, with a loss of 11.81 percent. Through the day, 12,21,068 shares were traded in the market with the current P/E ratio of the stock at 23.68. The 52 week stock price chart is on the left.

Piramal Healthcare, formerly Nicholas Piramal India, is engaged in pharmaceutical business mainly consisting of manufacturing and sale of own and traded bulk drugs and formulations. During the fiscal year ended March 31, 2009, Piramal acquired two brand groups, Anafortan and CEFI from Khandelwal Laboratories. Piramal Healthcare launched a total of 42 new products (including extensions) during fiscal 2009. The combined entity of Abbot and Piramal's formulations business would create one of the largest players in the country's generic drugs market.

Abbott, which is celebrating its 100th year in India and owns such brands as Creamffin, Brufen and Digene, will make an upfront payment of $2.12 billion to the Ajay G. Piramal-led firm, apart from $400 million annually for four years. Out of the 22 analysts following the stock, the consensus recommendation is outperform with the 10 analysts suggesting to buy the stock.

502.35, with a loss of 11.81 percent. Through the day, 12,21,068 shares were traded in the market with the current P/E ratio of the stock at 23.68. The 52 week stock price chart is on the left.

Piramal Healthcare, formerly Nicholas Piramal India, is engaged in pharmaceutical business mainly consisting of manufacturing and sale of own and traded bulk drugs and formulations. During the fiscal year ended March 31, 2009, Piramal acquired two brand groups, Anafortan and CEFI from Khandelwal Laboratories. Piramal Healthcare launched a total of 42 new products (including extensions) during fiscal 2009. The combined entity of Abbot and Piramal's formulations business would create one of the largest players in the country's generic drugs market.

Abbott, which is celebrating its 100th year in India and owns such brands as Creamffin, Brufen and Digene, will make an upfront payment of $2.12 billion to the Ajay G. Piramal-led firm, apart from $400 million annually for four years. Out of the 22 analysts following the stock, the consensus recommendation is outperform with the 10 analysts suggesting to buy the stock.

576.20, the stock touched its 52 week high of

576.20, the stock touched its 52 week high of  599.90, before collapsing to close trade at

599.90, before collapsing to close trade at  502.35, with a loss of 11.81 percent. Through the day, 12,21,068 shares were traded in the market with the current P/E ratio of the stock at 23.68. The 52 week stock price chart is on the left.

Piramal Healthcare, formerly Nicholas Piramal India, is engaged in pharmaceutical business mainly consisting of manufacturing and sale of own and traded bulk drugs and formulations. During the fiscal year ended March 31, 2009, Piramal acquired two brand groups, Anafortan and CEFI from Khandelwal Laboratories. Piramal Healthcare launched a total of 42 new products (including extensions) during fiscal 2009. The combined entity of Abbot and Piramal's formulations business would create one of the largest players in the country's generic drugs market.

Abbott, which is celebrating its 100th year in India and owns such brands as Creamffin, Brufen and Digene, will make an upfront payment of $2.12 billion to the Ajay G. Piramal-led firm, apart from $400 million annually for four years. Out of the 22 analysts following the stock, the consensus recommendation is outperform with the 10 analysts suggesting to buy the stock.

502.35, with a loss of 11.81 percent. Through the day, 12,21,068 shares were traded in the market with the current P/E ratio of the stock at 23.68. The 52 week stock price chart is on the left.

Piramal Healthcare, formerly Nicholas Piramal India, is engaged in pharmaceutical business mainly consisting of manufacturing and sale of own and traded bulk drugs and formulations. During the fiscal year ended March 31, 2009, Piramal acquired two brand groups, Anafortan and CEFI from Khandelwal Laboratories. Piramal Healthcare launched a total of 42 new products (including extensions) during fiscal 2009. The combined entity of Abbot and Piramal's formulations business would create one of the largest players in the country's generic drugs market.

Abbott, which is celebrating its 100th year in India and owns such brands as Creamffin, Brufen and Digene, will make an upfront payment of $2.12 billion to the Ajay G. Piramal-led firm, apart from $400 million annually for four years. Out of the 22 analysts following the stock, the consensus recommendation is outperform with the 10 analysts suggesting to buy the stock.