Aban shares up 27 percent on strong volumes

By

siliconindia | Wednesday, August 26, 2009

Bangalore: Aban Offshore (ABANOFFSH) ended the trading as one of the top gainers of the day with a gain of  325.90 (26.92 percent). The market of Aban opened its account today with a gain of

325.90 (26.92 percent). The market of Aban opened its account today with a gain of  53.55 to its previous close of

53.55 to its previous close of  1,210.45 and kept the gain momentum throughout the day. During the whole day, the stock touched a high of

1,210.45 and kept the gain momentum throughout the day. During the whole day, the stock touched a high of  1565 and a low of

1565 and a low of  1264, which is the lowest trading value in whole day. The stock touched a 52-week high of

1264, which is the lowest trading value in whole day. The stock touched a 52-week high of  2,505.50 and a low of

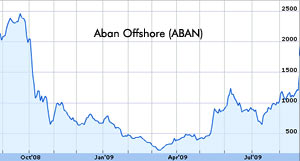

2,505.50 and a low of  224.10. With current P/E ratio of the stock at 65.30, in all 3,861,877 shares were traded throughout the day. With 3,861,877 units of shares, Sundaram BNP Paribas Select Thematic Energy holds the highest number of shares in Aban. The 52 week stock price chart is on the left.

Aban Offshore, formerly Aban Loyd Chiles Offshore, provides oil field services for offshore exploration and the production of hydrocarbons in India and abroad. Services comprise drilling services to manning and management. The company has two business segments: offshore oil drilling and production services and wind power generation. Drilling services cover the drilling of exploration wells, appraisal wells and production wells. The company has signed a contract worth $603 million (

224.10. With current P/E ratio of the stock at 65.30, in all 3,861,877 shares were traded throughout the day. With 3,861,877 units of shares, Sundaram BNP Paribas Select Thematic Energy holds the highest number of shares in Aban. The 52 week stock price chart is on the left.

Aban Offshore, formerly Aban Loyd Chiles Offshore, provides oil field services for offshore exploration and the production of hydrocarbons in India and abroad. Services comprise drilling services to manning and management. The company has two business segments: offshore oil drilling and production services and wind power generation. Drilling services cover the drilling of exploration wells, appraisal wells and production wells. The company has signed a contract worth $603 million ( 2,925 crore) for the deployment of three newly build jack-up rigs in the Middle East, In the Q1 ended June 30, 2009, Aban's revenue increased by six percent year-over-year (YOY) and three percent quarter-over-quarter (QOQ) to

2,925 crore) for the deployment of three newly build jack-up rigs in the Middle East, In the Q1 ended June 30, 2009, Aban's revenue increased by six percent year-over-year (YOY) and three percent quarter-over-quarter (QOQ) to  7,935 million. Of the total fleet of 20 rigs, the company operated 13 rigs during the quarter as against 11 rigs in Q1FY09.

Out of 19 stock analysts currently following Aban, consensus recommendation is hold, while four recommend to buy, two rate it as outperform and seven recommend to sell.

Other oil companies have also ended the trading in green zone. Great Offshore went up by 0.63 percent, Hindustan Oil gained by five percent and Reliance Industries up by 0.78 percent.

7,935 million. Of the total fleet of 20 rigs, the company operated 13 rigs during the quarter as against 11 rigs in Q1FY09.

Out of 19 stock analysts currently following Aban, consensus recommendation is hold, while four recommend to buy, two rate it as outperform and seven recommend to sell.

Other oil companies have also ended the trading in green zone. Great Offshore went up by 0.63 percent, Hindustan Oil gained by five percent and Reliance Industries up by 0.78 percent.

325.90 (26.92 percent). The market of Aban opened its account today with a gain of

325.90 (26.92 percent). The market of Aban opened its account today with a gain of  53.55 to its previous close of

53.55 to its previous close of  1,210.45 and kept the gain momentum throughout the day. During the whole day, the stock touched a high of

1,210.45 and kept the gain momentum throughout the day. During the whole day, the stock touched a high of  1565 and a low of

1565 and a low of  1264, which is the lowest trading value in whole day. The stock touched a 52-week high of

1264, which is the lowest trading value in whole day. The stock touched a 52-week high of  2,505.50 and a low of

2,505.50 and a low of  224.10. With current P/E ratio of the stock at 65.30, in all 3,861,877 shares were traded throughout the day. With 3,861,877 units of shares, Sundaram BNP Paribas Select Thematic Energy holds the highest number of shares in Aban. The 52 week stock price chart is on the left.

Aban Offshore, formerly Aban Loyd Chiles Offshore, provides oil field services for offshore exploration and the production of hydrocarbons in India and abroad. Services comprise drilling services to manning and management. The company has two business segments: offshore oil drilling and production services and wind power generation. Drilling services cover the drilling of exploration wells, appraisal wells and production wells. The company has signed a contract worth $603 million (

224.10. With current P/E ratio of the stock at 65.30, in all 3,861,877 shares were traded throughout the day. With 3,861,877 units of shares, Sundaram BNP Paribas Select Thematic Energy holds the highest number of shares in Aban. The 52 week stock price chart is on the left.

Aban Offshore, formerly Aban Loyd Chiles Offshore, provides oil field services for offshore exploration and the production of hydrocarbons in India and abroad. Services comprise drilling services to manning and management. The company has two business segments: offshore oil drilling and production services and wind power generation. Drilling services cover the drilling of exploration wells, appraisal wells and production wells. The company has signed a contract worth $603 million ( 2,925 crore) for the deployment of three newly build jack-up rigs in the Middle East, In the Q1 ended June 30, 2009, Aban's revenue increased by six percent year-over-year (YOY) and three percent quarter-over-quarter (QOQ) to

2,925 crore) for the deployment of three newly build jack-up rigs in the Middle East, In the Q1 ended June 30, 2009, Aban's revenue increased by six percent year-over-year (YOY) and three percent quarter-over-quarter (QOQ) to  7,935 million. Of the total fleet of 20 rigs, the company operated 13 rigs during the quarter as against 11 rigs in Q1FY09.

Out of 19 stock analysts currently following Aban, consensus recommendation is hold, while four recommend to buy, two rate it as outperform and seven recommend to sell.

Other oil companies have also ended the trading in green zone. Great Offshore went up by 0.63 percent, Hindustan Oil gained by five percent and Reliance Industries up by 0.78 percent.

7,935 million. Of the total fleet of 20 rigs, the company operated 13 rigs during the quarter as against 11 rigs in Q1FY09.

Out of 19 stock analysts currently following Aban, consensus recommendation is hold, while four recommend to buy, two rate it as outperform and seven recommend to sell.

Other oil companies have also ended the trading in green zone. Great Offshore went up by 0.63 percent, Hindustan Oil gained by five percent and Reliance Industries up by 0.78 percent.