10 Stocks I Would Want to Leave For My Grandchildren

By

siliconindia | Friday, November 4, 2011

Bangalore: "A good man leaves an inheritance to his children's children." : Proverbs 13:22a, Bible

What kind of gifts would you consider giving your children and grandchildren when you retire from active work?

In the days of my grandfather, leaving the next generations with cash, gold, and property was a good idea. Of course, this is a good idea even now.

But if you ask me if there's anything still better than these assets that I'd love to leave for my children and grandchildren, it would be a portfolio of 'double compounding' stocks.

You know the power of compounding, right?

In a bank, your

In a bank, your  1,000 deposit, which earns 10 percent (assume) annually, will turn to

1,000 deposit, which earns 10 percent (assume) annually, will turn to  1,100 at the end of year 1,

1,100 at the end of year 1,  1,200 at the end of year 2, and so on. This is the concept of simple interest.

In the stock markets, if your stock earns 10 percent in the first year, your investment at the end of year 1 will be Rs 1,100 (same as what your bank account will give). But at the end of year 2, at the same 10% return, your investment value will be

1,200 at the end of year 2, and so on. This is the concept of simple interest.

In the stock markets, if your stock earns 10 percent in the first year, your investment at the end of year 1 will be Rs 1,100 (same as what your bank account will give). But at the end of year 2, at the same 10% return, your investment value will be  1,210. This is because, during year 2, your 10 percent interest will not be on

1,210. This is because, during year 2, your 10 percent interest will not be on  1,000, but on

1,000, but on  1,100.

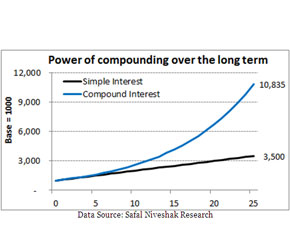

This is the concept of compound interest, which in simple terms means interest on interest. While you may say that the extra gain from stocks due to compound interest at the end of year 2 (Rs 1,210) isn't much as compared to what a bank account can give (Rs 1,200), see here how the power of compounding works over a 25 year period.

As the above chart shows,

1,100.

This is the concept of compound interest, which in simple terms means interest on interest. While you may say that the extra gain from stocks due to compound interest at the end of year 2 (Rs 1,210) isn't much as compared to what a bank account can give (Rs 1,200), see here how the power of compounding works over a 25 year period.

As the above chart shows,  1,000 invested now, and generating a return of 10 percent per year, will grow to

1,000 invested now, and generating a return of 10 percent per year, will grow to  3,500 at the end of 25 years when you earn simple interest from a bank.

The same

3,500 at the end of 25 years when you earn simple interest from a bank.

The same  1,000 invested in a stock, and which also returns 10 percent per year over the next 25 years, will grow to

1,000 invested in a stock, and which also returns 10 percent per year over the next 25 years, will grow to  10,835, or more than 3 times the bank deposit.

That's the power of compounding.

10,835, or more than 3 times the bank deposit.

That's the power of compounding.

1,000 deposit, which earns 10 percent (assume) annually, will turn to

1,000 deposit, which earns 10 percent (assume) annually, will turn to  1,100 at the end of year 1,

1,100 at the end of year 1,  1,200 at the end of year 2, and so on. This is the concept of simple interest.

In the stock markets, if your stock earns 10 percent in the first year, your investment at the end of year 1 will be Rs 1,100 (same as what your bank account will give). But at the end of year 2, at the same 10% return, your investment value will be

1,200 at the end of year 2, and so on. This is the concept of simple interest.

In the stock markets, if your stock earns 10 percent in the first year, your investment at the end of year 1 will be Rs 1,100 (same as what your bank account will give). But at the end of year 2, at the same 10% return, your investment value will be  1,210. This is because, during year 2, your 10 percent interest will not be on

1,210. This is because, during year 2, your 10 percent interest will not be on  1,000, but on

1,000, but on  1,100.

This is the concept of compound interest, which in simple terms means interest on interest. While you may say that the extra gain from stocks due to compound interest at the end of year 2 (Rs 1,210) isn't much as compared to what a bank account can give (Rs 1,200), see here how the power of compounding works over a 25 year period.

As the above chart shows,

1,100.

This is the concept of compound interest, which in simple terms means interest on interest. While you may say that the extra gain from stocks due to compound interest at the end of year 2 (Rs 1,210) isn't much as compared to what a bank account can give (Rs 1,200), see here how the power of compounding works over a 25 year period.

As the above chart shows,  1,000 invested now, and generating a return of 10 percent per year, will grow to

1,000 invested now, and generating a return of 10 percent per year, will grow to  3,500 at the end of 25 years when you earn simple interest from a bank.

The same

3,500 at the end of 25 years when you earn simple interest from a bank.

The same  1,000 invested in a stock, and which also returns 10 percent per year over the next 25 years, will grow to

1,000 invested in a stock, and which also returns 10 percent per year over the next 25 years, will grow to  10,835, or more than 3 times the bank deposit.

That's the power of compounding.

10,835, or more than 3 times the bank deposit.

That's the power of compounding.